We hear every day that there are many aged care providers operating at a loss. But while we hear that, we also see that many aren’t.

So – what are the high performers doing differently?

Firstly, to understand the picture more thoroughly: This week the Aged Care Financing Authority (ACFA) released it’s Ninth Report on the Funding and Financing of the Aged Care Industry Report. I’ve been devouring it over a cup of tea…and let’s face it, due to its length I may have extended into ‘glass of wine time’ too.

Although the report is largely based on the 2020 Financial year – it highlights a lot of the same themes we are seeing in 2021 through our MyVitals. Of course – there’s no real new or surprising news – but just because it’s not new or surprising doesn’t mean it’s any less jarring.

For this analysis I’ve also used our MyVitals database. MyVitals is Australia’s largest Aged Care benchmark with almost 140,000 beds to compare.

What do we see in this year’s report?

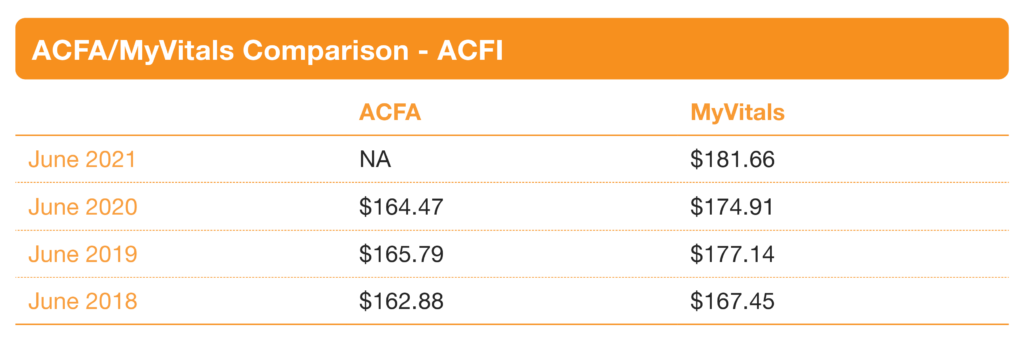

Total Revenue (Commonwealth & Resident funding sources only)

- $274.34 per resident per day

- Increasing from 2019 by $7.51 (3%) and $30.95 (13%) since 2016

The increase mainly relates to the COVID Supplement (a temporary increase) and the general indexation of supplements and subsidies.

* Benchmark excludes default residents to truly represent the claiming profile of the industry.

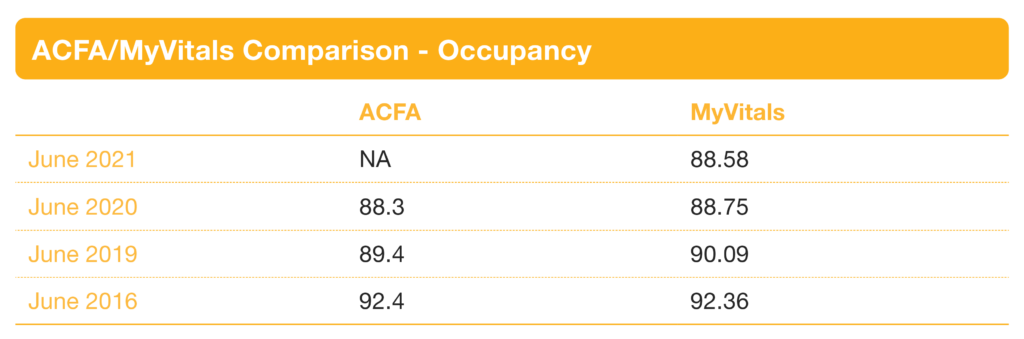

Occupancy

- 88.3% for the 2020 year

- Decreasing by 1.1% from the prior year and 4.1% over a 5-year period. ACFA also predicts that, based on the current age/sex specific usage of Residential Care, that demographics predictions will mean that occupancy will decline further in the 2020s before increasing in the 2030s. However, this may change depending on how the Home Care expansion impacts the age/sex specific usage of Residential Care in the future.

- Representing $328,440 lost in 2020 based on the 4 year occupancy drop*

*If we look at the financial impact of this drop on an average 80 bed facility, using our average Revenue per resident per day from above

Of course this somewhat correlates with a drop in direct costs, but we can’t forget the increase in overhead per Resident this also creates.

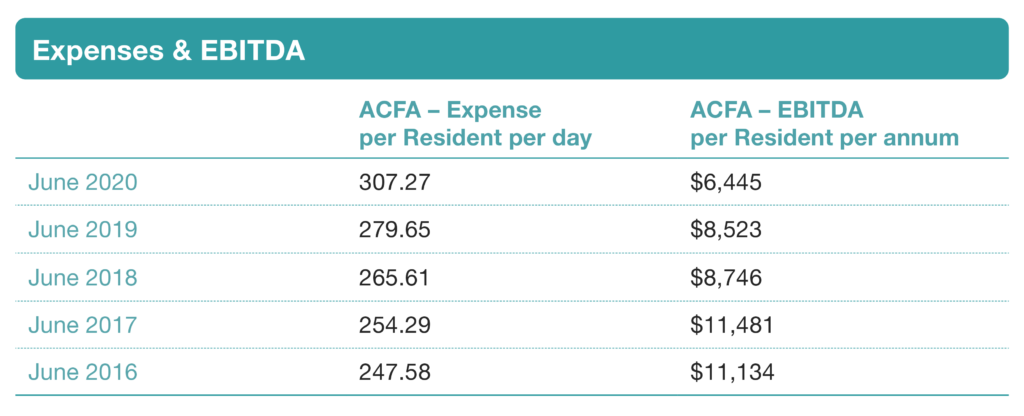

Of course with the compounding factors of:

- Occupancy dropping, as explored above, which increases overhead expenses per resident and reducing the positive impact of prior economies of scale per resident

- Expenses per resident increasing by 24% from 2016-2020 while revenue per resident has only had an increase of 12% over the same period.

- Meaning EBITDA margin has dropped 5.6% since 2016.

It’s NO WONDER Providers are doing it tough! There’s very little room for missed revenue or sloppy investment decisions. So why, although we see again and again that so many Providers are making a loss, are there many that aren’t? Many even have enough excess to cleverly invest into the High Impact Care and Quality of Life initiatives that we would all love to see and be part of!

So finally I get to my point! What are these Providers doing differently?

Well, we work with over 140,00 beds in the industry and what we are seeing is as follows:

1. High Performers focus on Investment, not just cutting costs

Cost Cutting – surely that’s the first place to start. Nope – this is where I think a lot of Providers go wrong!

There’s a huge difference between a cost cutting strategy and switching your strategy to look at every $ spent as an investment. One opens doors to long term value, sustainability and even growth while the other… at best…only aids short-term net income expectations but decreases longer term income expectations.

- Cost cutting ironically means a lot of time and money spent on saving money and little on making the future better and easier!

- Investment on the other hand – means looking at every $ spent and ensuring it’s an investment in your strategy and your future.

One example of this is:

If I had a dollar for every time someone exclaimed to me in the over 10 years of my time in the Aged Care industry “Did you know it takes over a million $ to turn around a sanctioned facility???”…well… I’d probably have enough $’s to, in fact…turn around a sanctioned Aged Care facility. Investing in proactive clinical and governance systems not only improves the client experience and increases revenue through Occupancy gains, but also reduces the risk of compliance. Proactive is ALWAYS cheaper and more effective than reactive.

Investing in revenue-generating activities and activities that enhance client experience are rarely bad investments!

As my Nanna always told me – spend wisely and make your money work harder than you do. Thanks Nan!

2. Revenue – Stop missing out on one single cent of your entitled funding and fees.

So how do you know if you’re missing out?

- Once your ACFI funding is under control – turn your focus to accommodation funding. In care in your facility right now – it’s likely that you have residents governed under at least 2 different and complicated funding systems. Although our Supplement Recovery service reviews past resident admissions to ensure no funding is missing, there will always be funding that cannot be recovered due to departed residents not having the correct information or changes in funding legislation. We can now review accommodation funding on a proactive basis for you.

- Resident fees (including Refundable contributions and deposits). Holy Moly – could they be more complicated? This area of Aged Care is complex and because of this, we don’t see many Providers getting it right – either missing out on Revenue, or creating huge compliance and Consumer experience risks with errors and constant adjustments. Our Fees & Funding Management service now provides your team with all the billing information you need, alerts and actions in order to get this function right.

- Transparency! High performers know what funding they’re missing and recover it early. It’s no surprise to me that the MyVitals average ACFI is slightly higher than industry performance. Seeing how you’re performing and comparing to like-organisations means you have a reliable source to identify early what you are missing. This of course will be absolutely critical as we transition to AN-ACC . You don’t want to wait a year to find out you’ve been dealt a lower hand than other Providers and could have fixed it easily.

- A little note about AN-ACC – it’s coming! It’s time to prepare now so that come transition you are receiving all your entitled AN-ACC funding. Please don’t make the mistake, as many Providers seem to be, of thinking that AN-ACC is a passive tool and care funding is being taken out of your control. This is far from the truth and there’s many actions you can be taking now to ensure you receive all your entitlements.

3. Occupancy – Let’s say that on average 1 bed in my facility is worth the equivalent of $300 per day in funding and fee equivalents. That means that each empty bed is costing $109,500 annually.

So how do you impact Occupancy?

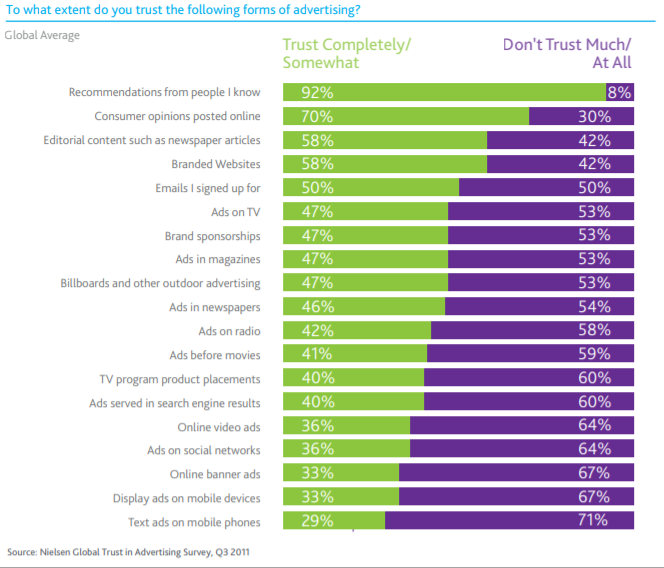

Well, in addition to your attraction strategies – the single most effective and also lowest investment method of acquisition is without a doubt – Referral. There are limited statistics available to Aged Care specifically, but I’m sure other industries won’t mind if I borrow some.

Even when using channels such as community groups or clubs, referral is still king within that channel.

And what is a referral? A Raving Fan. And – how do we create raving fans? Through a great client experience. Everything from the first meeting, the onboarding process, the agreement and subsequent billing process, the care delivered and more.

|

VICTORIA KELLY – MANAGING DIRECTOR Author |