We are back with another deep dive in our MyVitals Case Study series, where we look at different Aged Care Organisations using Provider Assist’s MyVitals software, and how they are using it to take control of their AN-ACC!

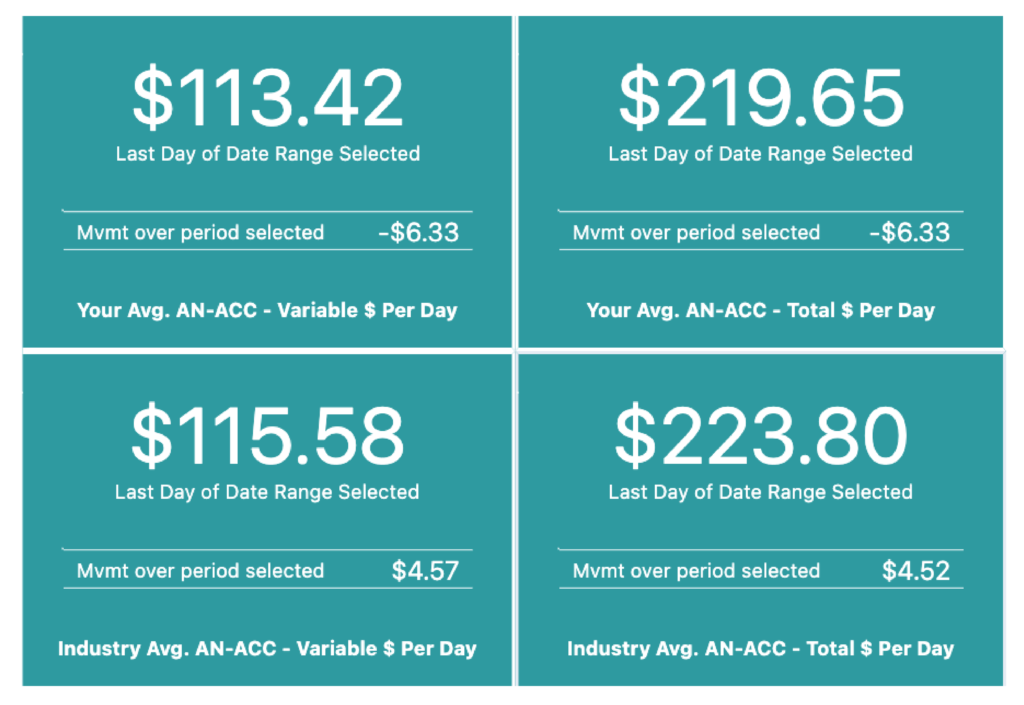

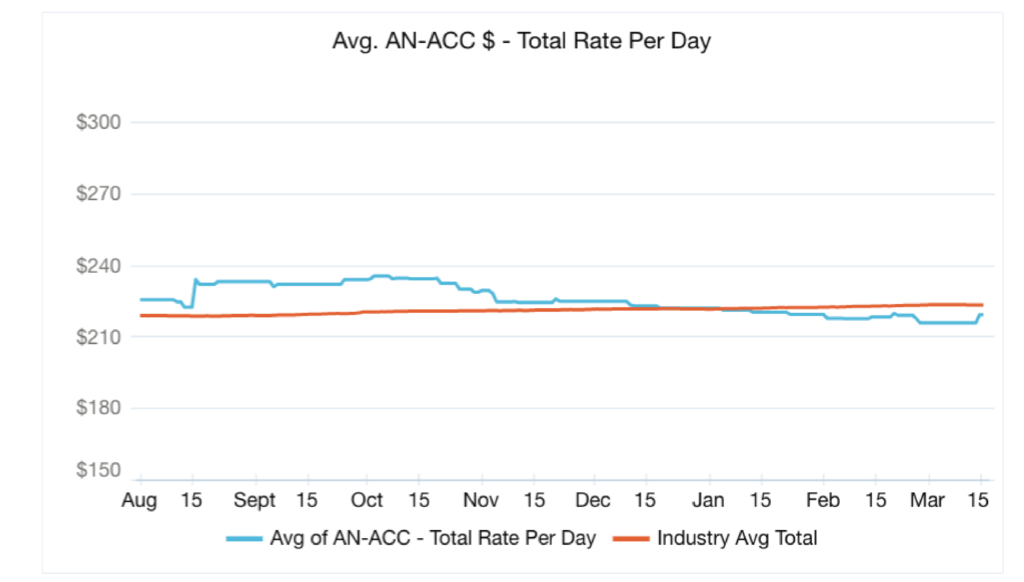

Let’s investigate a Provider that appears to have had a difficult transition from ACFI to AN-ACC. We can see their Total AN-ACC started above the industry benchmark, but has steadily dropped and is currently sitting below it. This results in a loss of $6.33 per day, compared to the Industry Benchmark which has increased $4.52 in the same period. This can be seen as a net loss of $10.85 a day, and even greater if we took their Max Total AN-ACC over the period!

So what’s going on here? This Provider was initially outperforming the Industry, but has since dropped. Let’s dissect this Provider and see if they could have done anything differently.

New Admissions and Initial Classifications

We will first have a look at their Resident Workflow, to see what has caused this decrease in funding.

Over this period, the Provider has had 22 entries and 22 departures. The Provider’s Average Initial Variable Funding is $6.18 lower than the Industry Benchmark. This is not of major concern, where it indicates their residents entering have lower care needs than the Industry.

A key focus of a Provider’s New Admission strategy should be to meet occupancy targets and to complete accurate assessments for Initial Assessments. Here we can see that the Provider is performing well by maintaining their occupancy. If all Initial Assessments accurately describe the care needs of their New Residents, this would demonstrate the Provider is effectively managing this component of their workflow.

Departures:

The average funding per departed residents for this Provider is $253.36, over $14 more than the Industry Benchmark. This suggests the Provider has seen Departures from Residents with High Care Classifications. This is actually what you’d want to see and is reflective of departing Residents’ care needs having increased throughout the duration of their stay.

Comparing the Departures against their New Admits, we can see that the New Residents do not completely offset the funding of the Departing Residents – which is again as expected. This is where reclassifications come in!

Reclassifications:

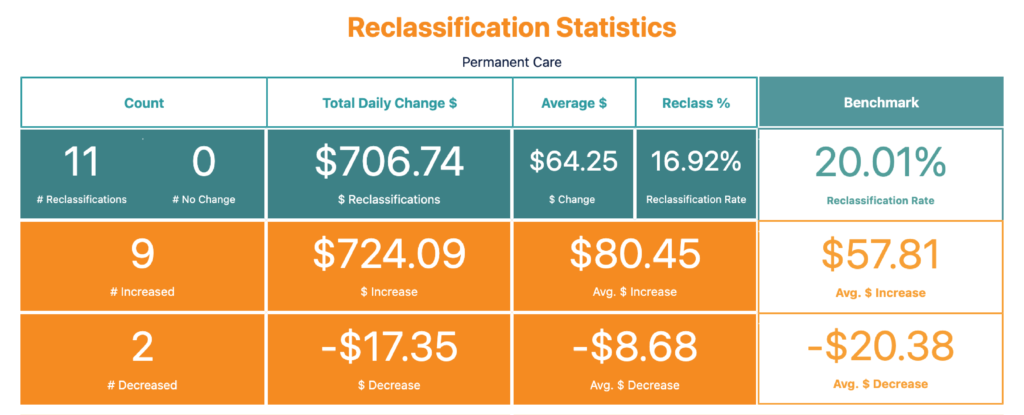

By completing and submitting reclassifications of Residents, a Provider can ensure that their Resident’s care needs are adequately met throughout the duration of their stay. This Provider has performed above average with their Reclassifications, where their Increases receive over $20 more and their Decreases receive almost $12 less than the Industry Benchmark. Great! So what’s the problem? Well, there are 2:

- Unfortunately – the Provider Reclassification Rate is just over 3% less than the Industry Benchmark, suggesting that there may be room for the Provider to complete more Reclassifications.

- Additionally, to consider this against their high Reclassification return, it could be that the Provider is waiting too long before applying for Reclassifications. By waiting, the Provider can guarantee a large Reclassification as they are only submitting Reclassifications when a major increase in a Resident’s care needs is noticed.

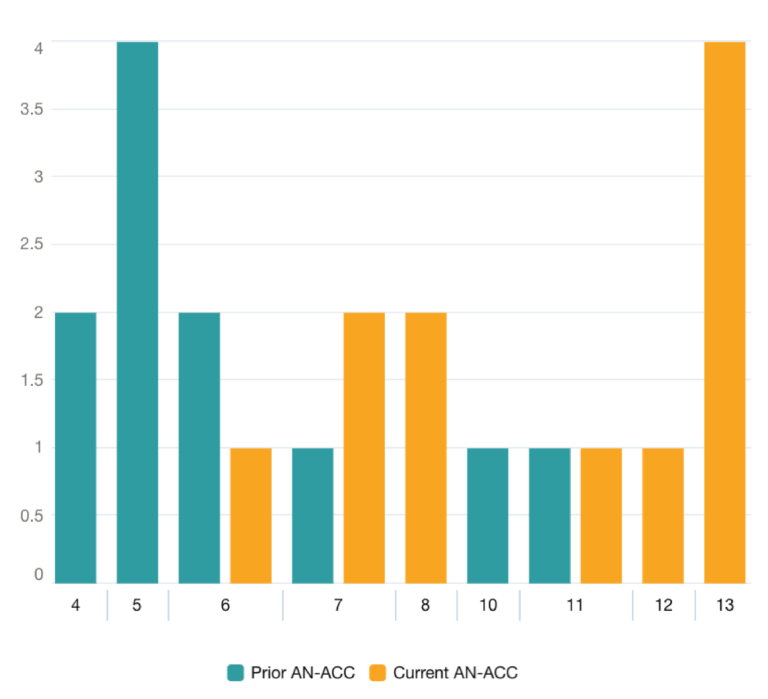

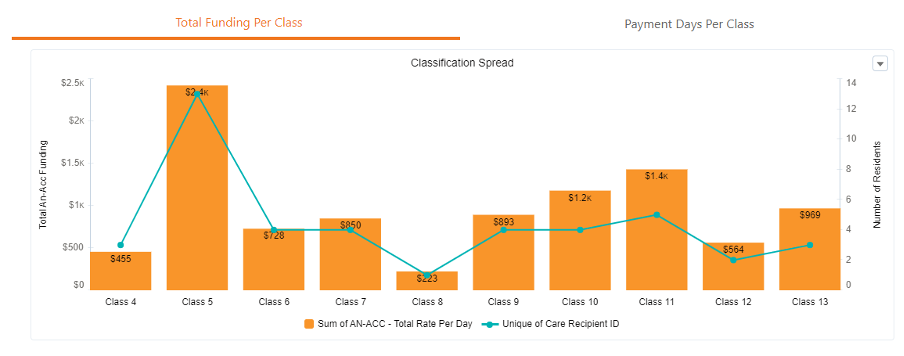

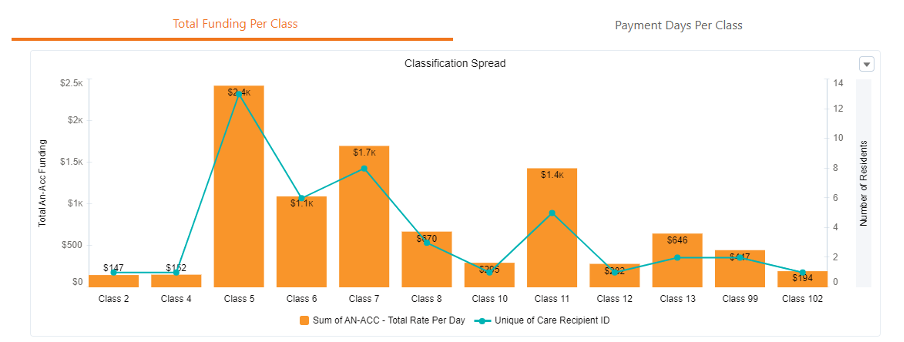

Class Mix:

The last piece of the puzzle is to compare the AN-ACC Classification Distribution of the Provider from now to the beginning. The histograms below demonstrate the Total Daily Funding per AN-ACC Classification, and also includes the count of Residents in each Classification.

Before:

After:

From this, we can see that the Provider has had a shift in case mix from the higher classifications (9 and above) to the middle classifications (6 to 8). By investigating the Provider’s Average Length of Stay per Resident, we can see that it has reduced by 0.8 Years over this Period from 3.5 to 2.7. As the Provider has newer Residents to Aged Care, it makes sense that their Care needs would also have reduced during this period.

So, we can see…

The good news for this Provider is that they had a solid foundation, providing them with a great start to the AN-ACC Funding Model, and this is reflected in their MyVitals stats.

Reclassifying earlier and optimising New Admits to be funded for the care being delivered will result in a quick turnaround for this Provider. Identifying when changes in care needs result in a new AN-ACC classification is the first key – for both New Admissions & Reclassifications, the Provider needs to prepare thoroughly for all type of Assessors & ensuring all assessments, care plans and care delivery were all congruent with the Resident’s care needs by ensuring:

- Assessment, documentation, care planning and care delivery is rooted in strong, proactive needs-based comprehensive assessment

- The whole clinical picture from assessment to care planning to care delivery is congruent

- The staff deeply understand assessed need and the AN-ACC tools so they can make better and more aligned decisions daily, and articulate that to the Assessors

- Residents & families understand their care and it meets their goals and preferences.

Want to see graphs like this for your Organisation too?

Get in touch with us to find out more about our MyVitals software for AN-ACC!

You can get in touch with us on 1300 419 119 or team@providerassist.com.au,

or book a MyVitals Demo now!

Author - Connor Chrisfield

Reporting & Data Analyst